child tax credit for december 2021 how much

College students or dependents age 18 through 24 will get a one-time payment of 500 in 2022 by the IRS. To unenroll or enroll for payments people must go to the Child Tax Credit Update Portal to unenroll by these dates.

Child Tax Credit Ending Will Push 10 Million Kids Back Into Poverty

The remaining 1800 will be.

. Get your advance payments total and number of qualifying children in your online account. Families with 17-year-old children will be eligible to claim the Child Tax Credit for the. The Child Tax Credit can be worth as much as 3500 per child for Tax Year 2021.

For 2021 the maximum amount of the credit is 3600 per qualifying child. We provide guidance at critical junctures in your personal and professional life. 112500 if you are filing as a head of household.

The final payment for the child tax credit will be made on 15 December. We dont make judgments or prescribe specific policies. The Child Tax Credit is intended to offset the many expenses of raising children.

The IRS has confirmed that the. Enter your information on Schedule 8812 Form. Since July the Child Tax Credit previously a once-a-year credit has been sent out in the form of a direct payment worth up to 300 per month for eligible families.

Families will be able to claim the. Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return. 150000 if you are married and filing a joint return or if you are filing as a qualifying widow or widower.

See what makes us different. Child Tax Credit 2021. If the modified AGI is above the threshold the credit begins to phase out.

Free means free and IRS e-file is included. From July to December of 2021 eligible families received an advance child tax credit up to 300 per child under six years old and 250 for children between the ages of six to 17. For 2021 the credit phases out in two different steps.

Max refund is guaranteed and 100 accurate. An individuals modified adjusted gross income AGI must be 75000 or under or 150000 if married filing jointly to claim the maximum credit of 3600 for a newborn baby in 2021. If your tax is 0 and your total earned income is at.

To reconcile advance payments on your 2021 return. To break it down the IRS will grant up to 3600 for kids up to age six divided by six monthly payments and half as a 2021 tax credit. Under the enhanced CTC families with children under 6 received a 3600 tax credit in 2021 with 1800 of that sent via the monthly checks or 300 per month.

For Tax Years 2018-2020 the maximum refundable portion of the credit is 1400 equal to 15 of earned income above 2500. How much money will families have received from Child Tax Credit by December 2021. 112500 or less for heads of household.

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. By August 2 for the August. This tax credit has helped millions of families every year and has been proposed to be expanded with the Trump Tax Reform.

The Child Tax Credit under the American Rescue Plan rose from 2000 to 3000 for every qualified child over the age of six and from 2000 to 3600 for each qualifying child under the age of six beginning in tax year 2021 the taxes you file in 2022. The 2021 Child Tax Credit will be available to nearly all working families with an income of under 150000 for couples or 112500 for a single-parent household. Payments up to 3000 will be given to eligible parents with kids aged six to 17 divided the same way.

The Child Tax Credit is designed to help with the high costs of childcare and the rising number of children in poverty in the United States. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

To be eligible for the maximum credit taxpayers had to have an AGI of. Temporarily allows 17-year-old children to qualify for the credit. Ad Tax Strategies that move you closer to your financial goals and objectives.

The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from 2000. Removes the requirement that households must earn at least 2500 to receive the credit. The Child Tax Credit was increased in 2021 to 3000 for children over the age of six and 3600 for children under the age of six up to 17 years old.

The enhanced child tax credit increased from 2000 to 3000 per child 17 and under and 3600 for kids under age six for the 2021 tax year. 75000 or less for singles.

Who S Eligible For The Child Tax Credit And What It Means This Tax Season Cnet

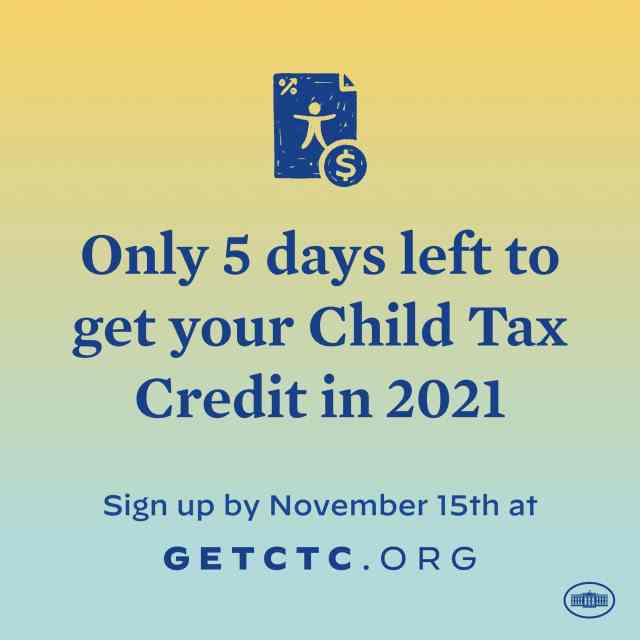

Childctc The Child Tax Credit The White House

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

Parents Guide To The Child Tax Credit Nextadvisor With Time

Legislative Momentum In 2022 New And Expanded Child Tax Credits And Eitcs Itep

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Child Tax Credit 2022 Could You Get 750 From Your State Cnet

The Child Tax Credit Toolkit The White House

The Monthly Child Tax Credit Calculator See How Much You May Qualify For Forbes Advisor

Will Monthly Child Tax Credit Payments Be Renewed Forbes Advisor

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca

Child Tax Credit 2022 Could You Receive A Double Monthly Payment In February Marca

The Child Tax Credit Toolkit The White House

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

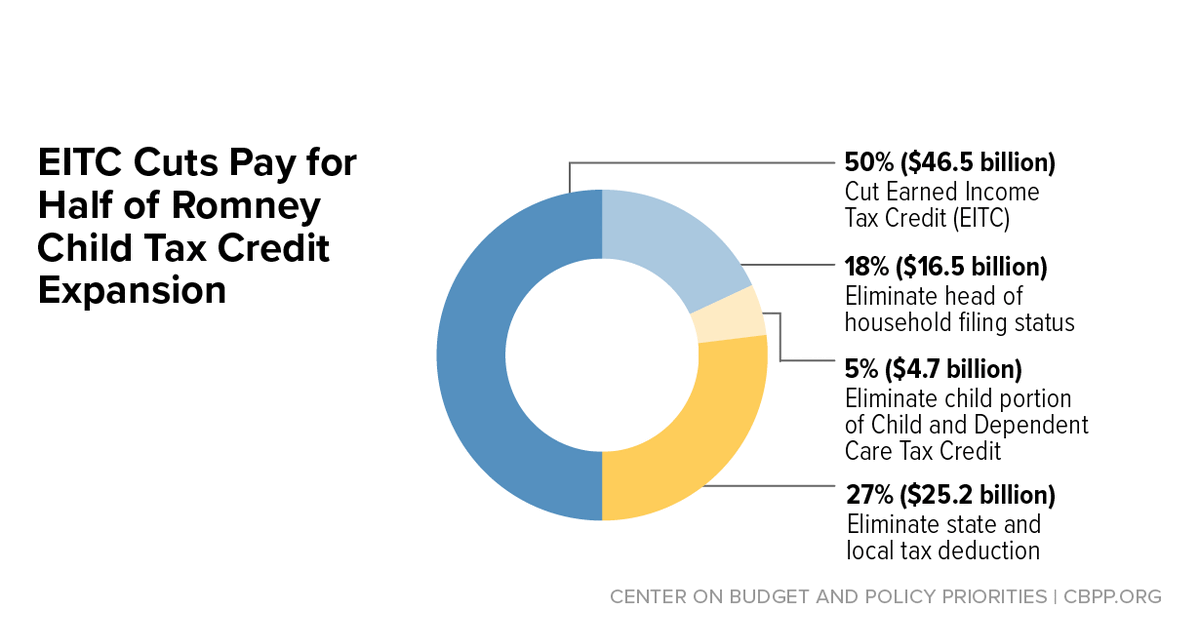

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities